In his Budget speech the Chancellor managed to claim several contradictory things at once about taxing the rich. First, he claimed the 50% top income tax rate was raising almost nothing. Next he claimed it was damaging the economy anyway. And finally, he tried to convince us that raising 5 times as much tax from the over £150,000 a year tax-payers was a golly good idea.

The first claim is nonsense. True, it wasn’t raising as much as was originally expected – it was only about £1.1bn instead of £3bn plus. This was because of a monumental level of tax avoidance as set out in the HMRC report on the matter. Most sensible observers would note that most of this tax avoidance was short-term juggling of tax liability between years and would have soon been mostly eliminated. Indeed HMRC estimated the 2011 income from this tax should have actually been a staggering £6.2bn if not for the fiddling (p39).

HMRC claims that the tax avoidance caused a very small drop in GDP (about 0.2%). This presumably is the basis for Mr Osborne’s claim it damaged the economy. This is somewhat specious as it is pretty clear that real economic activity didn’t really change much, just how it was accounted for. In any case, it’s hard to see how a tax no-one was paying, apparently, was damaging the economy?

But if Mr Osborne’s claim were true, presumably taking 5 times as much from this group would do 5 times as much ‘damage’ – minus 1% of GDP I presume?

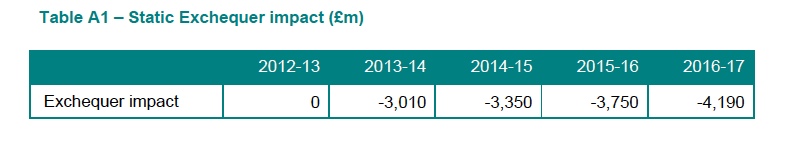

The truth is the 50% rate would probably have settled down to the actual HMRC projections of about £6bn a year. The result of dropping the rate from 50% to 45% are set out in the HMRC report. This means a drop of revenue of over £3bn rising to over £4bn (see table, HMRC report p48).

HMRC then uses a series of highly dubious “behavioural” assumptions to erode this tax-take away to only £1.1bn, still a tidy sum unless you are Mr Osborne apparently.

Even if you just ‘split the difference’ between what the HMRC’s report says and the actual tax liability then cutting the rate by 5% will mean about a £2bn a year loss to HM Treasury. Or to put it another way, about twice what Mr Osborne took away from pensioners in this Budget.

There is a perfectly respectable case for doing away with the 50% rate of tax. It is not one I agree with, certainly not in the short-term. But it is not the case mr Osborne made today, which consisted of sleight of hand and spuriously ‘exact’ calculations.

One final thought, Mr Osborne said a a few sentences before he announced the cut to 45% that the 50% was only temporary but was justified on the basis that public sector workers were taking a pay freeze because of the fiscal crisis. As far as I’m aware, they still are and many are now facing “regional” pay cuts as well.