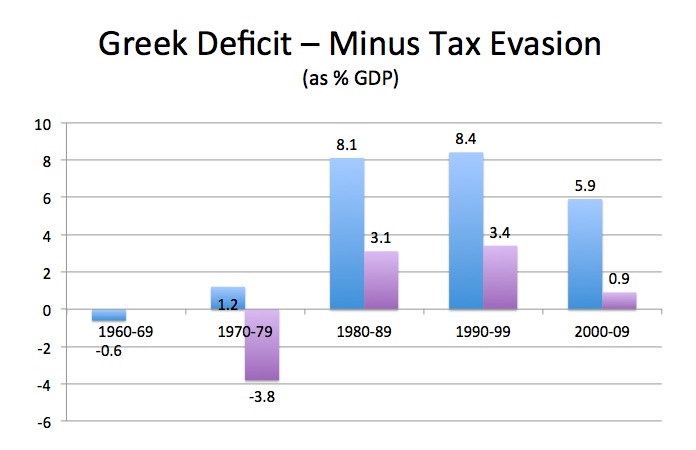

One issue that keeps coming up around the Greek crisis is the degree of tax evasion. In the slide below I report the average Greek budget deficit per year on a decade by decade basis since the 1960s (figures on the left – calculated from OECD figures in an excellent paper you can find here).

OECD has separately calculated that tax evasion in Greece constitutes about 5% of GDP. If this is deducted from the average annual deficit you get the figures for the deficit in the right-hand bar – a completely manageable level of deficit. This shows pretty conclusively that Greece’s main problem is not the size of the public sector (about average for an EU state) but the crisis of legitimacy of the Greek state which dates right back to post-war period, dictatorship and the failure to establish an accepted public administration system. It reinforces the point I have made earlier that in countries like Portugal, Spain, Italy and Greece a major component of the current problem is the insufficient development of what I would call a ‘democratic public administration’ that can guarantee things like tax and regulatory compliance and is reasonably free from patronage and corruption. Tax evasion is just a symptom of this failure.

[…] 6.Greek Deficit and Tax Evasion […]