Critical metals, such as lithium, cobalt, nickel, copper and manganese, are key to the path towards net zero. The UK Government released their Critical Minerals Strategy in early 2023, which sets out to improve the resilience of the critical metal supply chain. In this article from our publication ‘On Resilience’, Dr Sampriti Mahanty and Professor Frank Boons explore the resilience of critical metals, and evaluate the Critical Minerals Strategy.

- The increasing demand for certain metals means that some countries find their natural resources in increasingly high demand compared to others. The scramble for new critical metal supplies, and the dispersion of critical metal resources in particular geographies, raise geopolitical conflicts

- As climate targets become more ambitious, more minerals and metals will be needed for a low-carbon future. This increasing demand will be met by exploration and extraction from new metal sources, but it is important to consider that the extraction of metals is often a very energy-intensive process. The traditional extraction process has the potential to reduce the benefits of low-carbon technologies in terms of reducing carbon emissions.

- The implementation of solutions is only possible through the collaboration and commitment of system actors to a circular economy of technology metals.

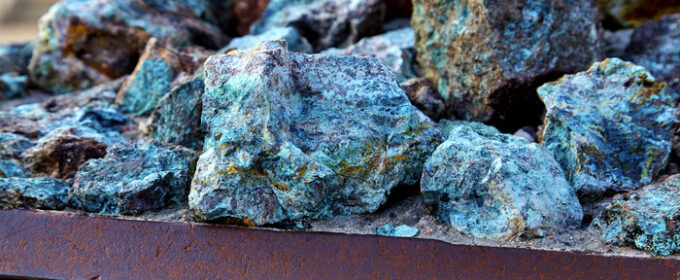

The pathway to net zero will put the mining and metals sector to the test. Many key ‘clean’ technologies – including batteries, fuel cells, electrolysers, and solar photovoltaics – rely on ‘critical’ metals such as lithium, cobalt, nickel, copper, manganese, and the ‘rare earth’ elements. The ‘criticality’ of these metals stems from their economic importance, the lack of alternative materials, and the risk of their supply chains being disrupted. As they become central to decarbonisation, the future looks more ‘metal intensive’ than ever, with various challenges arising for policymakers. Given the importance of such critical metals, the UK government released the Critical Minerals Strategy (CMS) earlier this year. The strategy sets out the plan for improving the resilience of the critical metal supply chain, underpinned by three main goals:

- Accelerate the growth of the UK’s domestic capabilities;

- Collaborate with international partners;

- Enhance international markets to make them more responsive, transparent, and responsible.

We unpack three challenges to these goals, some of which are acknowledged in the strategy, and some are not: geopolitical frictions, scarcity, and value conflicts.

The geopolitics of metals

The increasing demand for certain metals means that some countries find their natural resources in increasingly high demand compared to others. The scramble for new critical metal supplies, and the dispersion of critical metal resources in particular geographies, raise geopolitical conflicts. Such conflicts pose risks to international collaboration to improve supply chain resiliency. For instance, the control over critical metal supply – and the processing and manufacturing of clean technology – is becoming a significant element in the strategic and economic competition between the United States and China.

Since the outbreak of the US-China trade war, US companies are being urged by their government to pursue a more diversified supply chain, with less reliance on resources from China. However, the alternatives are similarly complex. Notably, several critical metals like tantalum fall into the category of ‘conflict metals’, as they originate in areas like the Democratic Republic of Congo, where trading of these resources has been used to finance armed conflict.

Scarcity of metals

As the demand for critical metals is on the rise, their scarcity could be driven by geopolitics or geology. Scarcity arising from geopolitics could potentially be resolved by exploring strategies like diversification of supply chains, and other strategies like ‘nearshoring’, ‘friend-shoring’, or ‘ally-shoring’ – moving production and jobs to perceived friendly nations.

Notwithstanding the complexity and difficulty involved in these strategies, the scarcity of metals arising from geology is even more difficult to solve. For instance, the International Energy Agency argues that the world could face lithium shortages in 2025. While the current shortages are often outcomes of market mechanisms and geopolitics, critical materials are a finite resource base, like any other naturally occurring resource, and this must be considered when designing a future state which depends heavily on them.

Policymakers should consider that net zero transition is not as simple as replacing one limited resource with another. Rather, it should, and must, involve a system-wide transformative change, rather than incremental changes to current technologies. For instance, owning an electric car can cause as many problems as a petrol one in the long run. To make mobility more sustainable, we need to explore transformative modes of production and consumption, such as shifting to public or shared transport powered by electric vehicles.

Value conflicts

As climate targets become more ambitious, more minerals and metals will be needed for a low-carbon future. This increasing demand will be met by exploration and extraction from new metal sources, but it is important to consider that the extraction of metals is often a very energy-intensive process. The traditional extraction process has the potential to reduce the benefits of low-carbon technologies in terms of reducing carbon emissions. Mining practices also have various harmful environmental impacts such as loss of biodiversity, erosion, and groundwater contamination.

Moreover, the extraction of metals could take place in a location that is far from the refining and manufacturing hubs, creating further emissions from transport which could reduce the potential environmental benefits of clean technologies. A prescient example of this can be found in the UK, where critical metals are beginning to be extracted in Cornwall, but processed in East Yorkshire. While this is a much shorter supply chain than procuring resources from China and brings welcome investment to economically deprived regions, policymakers should accelerate the ‘cluster’ approach outlined in the CMS (similar to the hydrogen and carbon capture plans) to further shorten the physical distances involved.

How can these barriers be overcome?

Firstly, diversification of the supply chain would improve resilience, and minimise risks arising due to the geopolitics of metals and ‘black swan’ events (for example, the invasion of Ukraine, which reinforced concerns over dependence on Russian resources).

Secondly, pursuing net zero targets along with principles of a circular economy (CE) could be a potential solution. A CE entails keeping materials in circulation, thereby reducing waste, and improving material efficiency. Circularity strategies have the potential to diversify and stabilise the supply chains of critical metals. Moreover, it also has the potential to reduce dependence on energy-intensive primary extraction. In the case of lithium, ‘urban mining’ from spent lithium-ion batteries (LiBs) could potentially reduce the need for primary extraction from the earth. However, the implementation of such solutions is far from straightforward, given the range of actors involved and the complexity of the problem.

To this end, we put forward two key areas that we are exploring at the National Circular Economy Centre (NICER) for ‘technology metals’ (Met4Tech); a consortium with companies, researchers, and policy actors, to maximise opportunities around the provision of technology-critical metals within the UK.

Roadmap to manage the metal-intensive future

The implementation of solutions is only possible through the collaboration and commitment of system actors to a circular economy of technology metals. The process of building a roadmap is often argued to be more important than the roadmap itself because it provides an opportunity to express commitment and collaboration among system actors. It enables clear articulation of the current state, goals, and action items to reach the vision of policymakers. The roadmap is due in 2024 and has been mentioned in the CMS as an initiative that enables the building of research and development expertise within the UK.

The creation of the roadmap will involve consultation with policy actors. The proposal for the Met4Tech has the Department for Environment, Food and Rural Affairs (Defra), the Department for Business, Energy, and Industrial Strategy (BEIS) and its successor bodies, and the devolved governments as key policy contacts who will be consulted in the road-mapping process. Other policy partners engaged in the Met4Tech roadmap are the Cabinet Office, Cornwall Council, the Department for International Trade, the Environment Agency, the Ministry of Defence, and the Coal Authority.

Incorporating Responsible Innovation in the metal-intensive future

The challenges we have outlined are complex, lack clear solutions, and are often unintended consequences that arise from potential solutions themselves. LiBs were proposed as a replacement for fossil fuels during the energy crisis in the 1970s, but 50 years later, we are tackling waste from spent batteries; the energy intensity of lithium extraction; and the potential shortages in lithium supply, which threaten the electric vehicle revolution. Responsible innovation will aim to transform innovation practices to become more anticipatory, reflexive, inclusive, and responsive. In our work at Met4Tech, we aim to bring in principles of Responsible Innovation while designing a CE of technology metals, thereby avoiding (as much as possible) any unintended consequences in the short- and long-term. Policymakers also need to take into consideration such unintended consequences as the new CMS starts to take shape in the real world.

The Critical Minerals Strategy is a start, but the UK can, and must, go further.