Most of the commentary around the last Budget of this Parliament will, predictably, focus on the contents of George Osborne’s little red briefcase.

Few will focus on what might happen afterwards – the Parliamentary procedure for implementing Budgets. That’s because these are usually pretty uncontroversial – Budget announcements usually get ‘rubber stamped’ through Parliament with little fuss and bother. But maybe not this time….. as I speculated before.

The House of Commons archaic Standing Order 48 effectively prevents, for spending, anyone putting forward proposals other than “the Crown”. No, not Her Maj – in this case it means ‘the Government’ (which is in our system HM Government remember).

This ‘rule’ has been extended, in practice, to proposals for taxation – so only ‘the Crown’ can propose to maintain, or raise, or introduce new taxes.

This somewhat bizarre provision means all MPs can do is either endorse the Government’s proposed spending plans or, and this happens very rarely, propose to reduce spending (or taxes) on something or other. They could also, in theory, reject all the spending (and tax) proposals – although to my knowledge that has never been tried in modern times.

It used to be thought that any vote against the Government in this process would be an automatic vote of no-confidence and therefore trigger its resignation and an election. This has never actually been the case (the government has lost votes on ‘supply’ and tax without a crisis) and since the Fixed Term Parliament Act is definitely not so.

But it is the origin of the so-called “confidence and supply” idea so often used by journalists in discussion of possible minority government arrangements in the event of an inconclusive General Election or ‘hung parliament’.

But in the new multi-party, Coalitional, world of Westminster who knows what will happen after March 18th?

- Will George Osborne include in his Budget proposals NOT agreed with the Lib Dems – and if he does would they (LDs) dare join forces with Labour and others to vote down spending or tax proposals they don’t like?

- Could the LDs take the initiative and in the name of ‘differentiation’ put forward some highly symbolic amendment of their own on tax or spend – for example rejecting some Tory tax cut aimed at boosting Conservative chances in the GE?

- Could Labour do the same? Or the SNP put forward an amendment to cut MOD spending on Trident (their symbolic differentiator from Labour)? Or the two UKIP MPs propose amendments to not pay our subs to Brussels?

There are all sorts of possibilities. But my guess at the moment is that Westminster traditions are still too strong – so entrenched that most MPs in the House of Commons still don’t even realise they could make all sorts of mischief even within the arcane restraints of Standing Order 48 and parliamentary customs.

But I’d also guess these fetters on Parliament will not long survive another Coalition or even more likely minority Government after May 2015.

UPDATE

BUDGET 2015 – The Big Picture on Public Spending

When is a “Long Term Economic Plan” not a “Long Term Economic Plan” – when there’s an election coming.

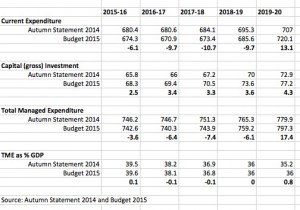

In his Autumn Statement Chancellor Osborne announced spending cuts throughout the next Parliament that would have reduced spending to 35.2% of GDP – which as the OBR pointed out would be the lowest since the 1930s.

In Budget 2015 the total spending plan for 2019-20 has suddenly jumped – to 36% of GDP (a whole 0.8%).

This has been achieved by a sudden £17.4bn jump in spending in 2019-20 (see below), but a significant drop in spending earlier in the Parliament compared to the Autumn ‘Long Term Plan’.

This extra £17.4bn in 2019-20 looks very much like a deliberate sleight of hand purely to ensure the 35.2% of GDP is tweaked upwards.

The Autumn Statement vs the Budget – when is a Plan not a Plan?