This is the forty-second in a series of posts by Dr Robert Ford, Dr Will Jennings, Dr Mark Pickup and Prof Christopher Wlezien that report on the state of the parties in the UK as measured by opinion polls. By pooling together all the available polling evidence, the impact of the random variation that each individual survey inevitably produces can be reduced.

Most of the short term advances and setbacks in party polling fortunes are nothing more than random noise; the underlying trends – in which the authors are interested and which best assess the parties’ standings – are relatively stable and little influenced by day-to-day events. If there can ever be a definitive assessment of the parties’ standings, this is it. Further details of the method used to build these estimates of public opinion can be found here.

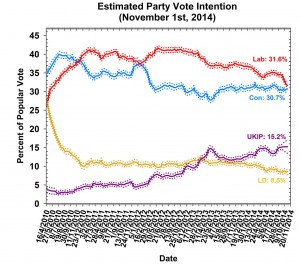

In last month’s Polling Observatory we noted remarkable stability in the polls despite a hugely eventful political month. This month we find the opposite pattern. A relatively subdued political month has been accompanied by one of the largest shifts in opinion we have observed since the beginning of this parliament. Labour’s vote share, at 31.6%, is down 2.8 points in just a month, erasing nearly all of the fragile lead over the Conservatives that the party have been clinging to over the past six months.

This plunge in support is among the largest shifts in opinion we have recorded since 2010, and implies that about one in twelve Labour voters has drifted away from the party in the past few weeks. A significant part of this drop may be the result of the seismic shift in opinion north of the border, where support for the Scottish National Party has surged dramatically, threatening Labour’s long hegemony in Scottish Westminster polls and votes.

The Conservatives, by contrast, have recovered some of the ground they lost last month, rising 0.6 points to 30.7%. The top two parties are now within just a single percentage point of each other, pointing to a tightening race with just six months to go to the general election.

Meanwhile UKIP have consolidated their large gain last month, and are stable on 15.2%. However, as the widening dashed lines around our latest UKIP estimate indicate, there is an unusually high degree of uncertainty about UKIP support at the moment. This reflects the substantial spread in UKIP support in the polls. Some pollsters are showing the party at 20% or higher, and indeed in the aftermath of the Clacton by-election one Survation poll reported UKIP as high as 25% (and another ComRes poll put them on 24% around the same period). In contrast, other pollsters have them stable in the mid-teens, for example with both Populus and YouGov often finding UKIP support in the 13% to 15% range.

As we have discussed previously, our method makes it possible to estimate the ‘house effect’ for each polling company for each party, relative to the vote intention figures we expect from the average pollster. That is, it tells us simply whether the reported vote intention for a given pollster is above or below the industry average. This does not indicate ‘accuracy’, since there is no election to benchmark the accuracy of the polls against.

It could be, in fact, that pollsters at one end of the extreme or the other are giving a more accurate picture of voters’ intentions. In the table below we report the ‘bias’ towards or against each of the parties for all current polling companies. From this, it is quickly apparent that the largest range of house effects are found in the estimation of UKIP support, with Survation’s figures 4.3 points higher than the average pollster, followed by Opinium at 2.8 points higher and Lord Ashcroft at 2.1 points higher.

In contrast, ICM put UKIP 2.6 points lower, ComRes (telephone) 2.5 points lower and Ipsos-MORI 1.8 points lower. As when we reported on this previously, the uncertainty seems to be associated with the method a pollster employs to field a survey. All the companies who poll by telephone (except Lord Ashcroft’s weekly poll) tend to give lower scores to UKIP. By contrast, three of the five companies which poll using internet panels give higher than average estimates for UKIP. The diversity of estimates indicates the continued uncertainty about the extent to which UKIP is reshaping the political landscape at the present time, where the lack of a clear precedent means that pollsters have little previous information to use to calibrate their estimates.

With the top two parties effectively tied, and the pollsters divided about the performance of the surging insurgents who may decide their fates, the outcome of the 2015 election has never been less certain.

| House | Mode | Adjustment | Prompt | Con | Lab | Lib Dem | UKIP |

| ICM | Telephone | Past vote, likelihood to vote | UKIP prompted if ‘other’ | 1.3 | -0.8 | 2.7 | -2.6 |

| Ipsos-MORI | Telephone | Likelihood (certain) to vote | Unprompted | 0.5 | 0.3 | 0.5 | -1.8 |

| Lord Ashcroft | Telephone | Likelihood to vote, past vote (2010) | UKIP prompted if ‘other’ | -0.9 | -0.6 | -1.0 | 2.1 |

| ComRes (1) | Telephone | Past vote, squeeze, party identification | UKIP prompted if ‘other’ | 0.3 | -0.1 | 0.1 | -2.5 |

| ComRes (2) | Internet | Past vote, squeeze, party identification | UKIP prompted if ‘other’ | 0.3 | -0.7 | -1.0 | 1.8 |

| YouGov | Internet | Newspaper readership, party identification (2010) | UKIP prompted if ‘other’ | 1.9 | 2.1 | -1.3 | -0.4 |

| Opinium | Internet | Likelihood to vote | UKIP prompted if ‘other’ | -0.8 | -0.8 | -2.2 | 2.8 |

| Survation | Internet | Likelihood to vote, past vote (2010) | UKIP prompted | -1.7 | -1.4 | -0.3 | 4.3 |

| Populus | Internet | Likelihood to vote, party identification (2010) | UKIP prompted if ‘other’ | 2.4 | 1.7 | 0.1 | -2.1 |

Another polling sub-plot which emerged this past month has been the emergence of the Greens as yet another potent force in the fragmenting political landscape. A number of polls have put their support at 6% or 7%, a massive increase on their 2010 showing of less than 1% (though this is artificially deflated as the party stood candidates in less than 50% of constituencies), and close to or even above the struggling Liberal Democrats.

We do not currently estimate support for the Greens, but will investigate adding them to our model if the current surge in support is sustained. Currently, we have the Lib Dems at 8.5%, up 0.3 points on last month. Although falling behind the Greens is symbolically bad for the party, and provides seasoned poll watchers with an exciting new story, the substantive impact of this new twist is likely to be limited. The Lib Dems’ fate still depends on how well they can hold on to votes in their traditional constituency strongholds.

Despite the sharp fall in their support this month, Labour still hold important structural advantages thanks to the biases in the electoral system, which mean their votes translate more effectively into seats. Lord Ashcroft has been doing the psephological community a huge service by systematically polling the individual marginal seats which will decide the result next year.

Using this method, he has already identified enough prospective Labour gains to put the party ahead on seats next year, and he still has many more strong prospects to poll. However, as Lord Ashcroft’s himself wisely reminds us, polls are a snapshot not a prediction, and Labour’s leads in many key marginals look awfully fragile. The opposition remains, slightly, in front for one more month. But there are six more to go, and if just one of these looks like October, the contest will be thrown wide open.