In this blog, William Bodel a post-doctoral research associate at the Dalton Nuclear Institute at The University of Manchester, looks at the future of low-carbon energy generation in the UK to see whether nuclear energy should support the UK Government’s climate change commitments.

- Concerns around climate change, and the political drive to achieve net-zero greenhouse gas emissions has pushed nuclear energy back onto the agenda in the UK.

- Nuclear is often overlooked as a low-carbon option when it comes to power generation, however it has a long history of providing reliable low-carbon electricity.

- Operating alongside renewables, new nuclear could be the only way to provide the reliable, low-carbon energy needed to ensure the UK achieves its carbon reduction commitments. The government must take it seriously as an option.

- The market alone cannot deliver nuclear projects because the risk drives up investment costs. Government must resolve the nuclear financing issue if it is to successfully encourage private sector investors.

On the face of it, the UK has seemingly made admirable progress in its target to reduce greenhouse gas (GHG) emissions by 80% from 1990 levels by 2050, having met its first two carbon budgets and is on track to meet its 2022 target. Closer inspection however leads to a more cynical appraisal. The 1990 benchmark year coincides with the privatisation of the UK electricity industry. The resulting “Dash for Gas”, driven by non-environmental factors, led to the demise of coal generation in the UK, and also killed any future for new nuclear. The coal to gas transition is responsible for much of the UK’s progress on GHG emissions so far.

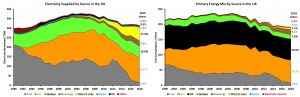

That’s not to say that real progress has not been made in the expansion of renewable generation. At first glance of the data (Figure 1) on electricity generation, one could imagine that continued renewable expansion, at its recent trajectory, will solve the energy crisis by 2050; but of course, most emissions arise from means other than electricity generation, such as heating and vehicle fuel. This is key to understanding our present situation. The data presented shows the important difference between electricity supply and energy use. When faced with the primary energy mix data, it’s clear just how much further there is to go.

Figure 1. Energy ≠ Electricity

The period since 1990 has been defined by the exchange of coal for natural gas in electricity generation [data: BEIS]. When considering primary energy use [data: BEIS], the reliance on fossil fuels is more apparent.

This explains why the UK is currently on track to miss its fourth carbon budget in 2027. Despite improvements in building insulation and vehicle fuel efficiency, the ultimate dependence of the UK on natural gas for heating and petroleum for vehicles has not changed. Progress in these areas is key for the government in order meet its ambitious GHG reduction targets, and is more complex to solve than decarbonisation of the existing electricity supply.

Solutions?

The two realistic potential solutions are: 1) Electrification of vehicles and heating 2) Development of suitable energy storage methods such as batteries, hydrogen or synthetic hydrocarbon fuels. Both solutions face huge challenges before they can contribute significantly to emissions reduction. The key common factor is that they both require a large increase in low-carbon power generation in order to deliver – any transition to electric heating and vehicles is pointless if that electricity comes from burning coal or gas.

So the question is, how should this new low-carbon power be generated?

The low-carbon generation methods available are Carbon Capture and Storage (CCS), biomass, non-thermal renewables and nuclear; and each has its flaws. CCS is a technology in its infancy, its efficacy and cost-effectiveness remains to be demonstrated. Biomass requires attention to sourcing to ensure sustainability, with an inferred ceiling of 15% of primary energy. Hydroelectricity has few options for expansion. Wind and solar are attractive, but have low capacity factors, and effects on the grid if their share of the total is too much.

The Nuclear Option

Nuclear is usually the unpopular choice when considering new power generation, but it has a long history of providing reliable low-carbon electricity. Nuclear power generation, offers the firmness that renewables lack and working together with other low-carbon technologies, could be the only way to provide the energy needed to ensure the UK achieves its carbon reduction commitments.

So if nuclear offers a partial solution to our energy woes, why aren’t we expanding nuclear capacity as we are renewables? In short – we’re trying to.

Whilst concerns around finding long-term waste solutions exist, the big obstacle to new Nuclear Power Plants (NPPs) is financing. Up-front capital investment for nuclear strongly dominates its electricity price compared with other generation methods. NPPs are big, expensive projects – such that historically, only governments have funded them. What makes NPPs attractive is that once initial capital costs are invested and a plant becomes operational, the small marginal costs make nuclear competitive if averaged over its 60+ year lifetime.

Modern NPPs have advanced beyond 1960s designs. Some new designs operate at high temperatures, offering process heat and hydrogen production. Future reactors will be smaller, with modularisation reducing plant price and build time, lowering investment risk and making investment more palatable to investors. These are future aspirations though; solutions to help construct existing larger systems need to be found in the meantime. Politically, government financed NPPs are not an option and a financing solution with the private sector is desirable.

Financing

Recent attempts at resolution have used the “Contract for Difference” (CfD) model. This encourages delivery of the new Hinkley Point C by agreeing a guaranteed electricity price with the developer. The big flaw with CfD is that it is a very inefficient method of financing a NPP – once the plant is delivered, risk drops to almost nothing, but consumers remain locked into paying a high price for 35-years for the electricity produced. Is there another way new NPPs can be delivered?

Enter the Regulated Asset Base (RAB); a financing model which recently underwent government consultation to which researchers from the Dalton Nuclear Institute have contributed. Whereas CfD incorporates a strike price through which the developer recoups its up-front investment and borrowing costs, the RAB provides revenue to the construction company during construction – this revenue stream reduces risk and reliance on financing early on in the project where it really matters, reducing the up-front costs.

Whilst details on specifics of any RAB implemented remain for a future consultation, government should seriously consider developing it as an alternative to CfD. Successfully encouraging the private sector to invest in and deliver future NPPs would enable nuclear to be a major contributor in reducing emissions in the UK.